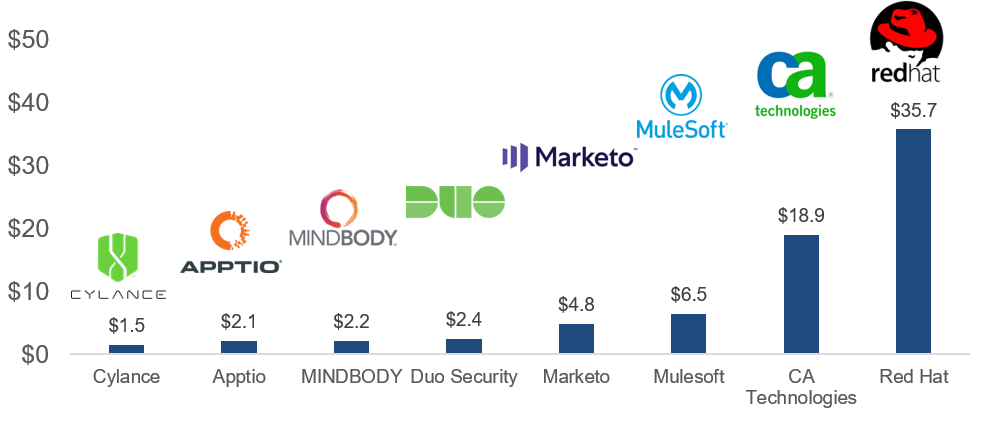

Application Software Transactions Lead the Pack in Deal Volume and Size

During the 4thquarter of 2018, application software deals were the most prevalent, accounting for 49.2% of 63 total transactions tracked by Pharus in the Software and Services space. These deals also yielded the biggest price tags, indicating the continued appetite for software companies from both financial and strategic acquirers.

In December, MINDBODY (NasdaqGM:MB), a cloud-based business management software and payments company, was acquired by Vista Equity Partners for $2.2 billion at 7.4x revenue. Shareholders received $36.50 in cash per share, representing a 68% premium to share price at the announcement.

In November, the former mobile phone maker Blackberry (TSX:BB) acquired Cylance Inc., which develops an antivirus and endpoint protection solutions using artificial intelligence for $1.5 billion. The transaction is representative of Blackberry’s pivot from telecom hardware towards cybersecurity.

Earlier in November, Apptio (NasdaqGM:APTI), a cloud-based technology business management applications and software provider was acquired by Vista Equity Partners for $2.1 billion, a 7.1x EV/Revenue multiple.

The most significant of these deals took place in October, when IBM (NYSE:IBM) acquired open source software solutions provider Red Hat (NYSE:RHT) for a staggering $35.7 billion, representing a 10.8x multiple of revenue and the largest software deal of the year.

The Red Hat acquisition is just the latest in a string of major software acquisitions by tech giants throughout 2018 including Adobe’s acquisition of Marketo for $4.8 billion, Cisco’s acquisition of Duo Security for $2.4 billion, Broadcom’s acquisition of CA Technologies for $18.9 billion and Salesforce’s acquisition of Mulesoft for $6.5 billion.”