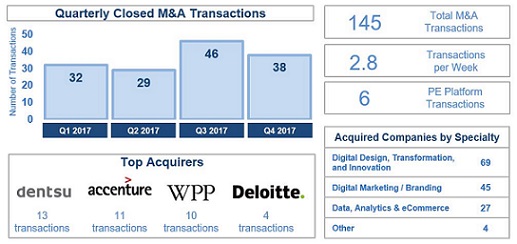

Extraordinary Sustained M&A Activity in the Digital Services Sector

It seems like the Digital Services sector did not get the memo. Spending on deals in the tech M&A market during 2017 slumped by more than one-third compared with 2016 and 2015 (451 Research). However, we at Pharus observed extraordinary M&A appetite for digital services companies witnessed in 2016 continue throughout the past year. We observed an impressive 145 total transactions in the space or approximately 3 transactions per week. The frenzy was led by traditional global ad agencies and major service providers / consultancies in hot focus areas of digital design, user experience, digital transformation, and digital marketing. To keep pace with the rapidly transforming digital space, large firms have dished out cash to buy and/or bolster capabilities to become experts in the latest technologies and digital competencies (Forrester).

While digital services acquisitions has been observed globally with many deals taking place in the US, the UK and Australia have been hot markets that continued to attract acquirers. Both regions have already seen activity from the gorillas in the space over the past few years. Accenture, for instance, has been on a prolonged digital services acquisition spree which has included Sydney-based creative agency The Monkeys, Australian ad agency Reactive Media, and UK creative agency Karmarama over the past two years. In Q4, we saw this trend continue in the UK. Digital marketing investment group Stagwell Group was an active acquirer in December 2017 as the company acquired London-based digital marketing agency Forward3D Group. The deal marked Stagwell’s sixteenth transactions since it was founded with $250M in funding. The company’s mission is to reinvent the traditional ad agency holding company model by focusing on digital-first marketing services (WSJ). UK’s market also saw the likes of heavyweights like ad agency Cheil Worldwide and IT services firm Cognizant. Cheil announced the acquisition of UK-based digital marketing agency Atom42 and Cognizant announced their acquisition of full-service digital agency Zone.

With Australia M&A ending the year at a lofty 6-year high (Reuters), it’s no surprise that we continue to see digital service transactions in the region. In mid-December 2017, marketing and relationship platform operator ShareRoot acquired Australian social media / digital marketing agency The Social Science. In October, we observed even more large name acquirers as IBM acquired Sydney-based digital and innovation agency Vivant Digital to scale capabilities for its internal agency IBM iX.